hawaii fast food sales tax

Ad Lookup HI Sales Tax Rates By Zip. This is the total of state county and city sales tax rates.

Hawaii Income Tax Hi State Tax Calculator Community Tax

Hilo is located within Hawaii County HawaiiWithin Hilo there.

. The average cumulative sales tax rate in Hilo Hawaii is 45. The County sales tax. This is the Connecticut state sales tax rate plus and additional 1 sales tax Florida Prepared food for immediate consumption sold in Florida is generally taxable.

The Hawaii sales tax rate is currently. 5 hours agoCity and County of Honolulu Toastmasters president 2022-present. The average cumulative sales tax rate in the state of Hawaii is 443.

The most populous county in. The issue of sales and use tax on purchases of materials comes up regularly on NJ tax audits sometimes resulting in a substantial assessment. In some of these states local governments add their own sales tax on food sales More commonly local governments exempt food from sales taxation if food is exempt at the.

A GET Exemption for Food. Average Local State Sales Tax. General excise tax GET is levied on a business for the.

NJ contractors are considered the. While Hawaiis sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Free Unlimited Searches Try Now.

Average Sales Tax With Local. This includes the rates on the state county city and special levels. 31 rows The state sales tax rate in Hawaii is 4000.

This page describes the taxability of. Restaurant tax on Maui is 413. Maximum Possible Sales Tax.

This takes into account the rates on the state level county level city level and special level. With local taxes the total. Hawaii State Sales Tax.

2022 List of Hawaii Local Sales Tax Rates. Hawaii is one of five states that employs the income tax credit or rebate approach to lower the negative impacts of sales taxes on low income residents. There has been a lot of talk these days about possibly adding a General Excise Tax GET exemption for food and medicine.

However my Safeway grocery bill from today looks like tax is almost 6. Lowest sales tax 4 Highest sales tax 45 Hawaii Sales Tax. Vice-president of membership 2018-2022.

Currently combined general excise tax rates in Hawaii range from 4 percent to 45 percent depending on the location of the sale. The minimum combined 2022 sales tax rate for Honolulu Hawaii is. Hawaii has state sales tax of 4 and.

Maximum Local Sales Tax. We pay 175 tax on food at home in Illinois and a alcohol is 7 there.

The Home Seller S Guide To Understanding Comparable Sales Real Estate Prices Selling Real Estate Sell Your House Fast

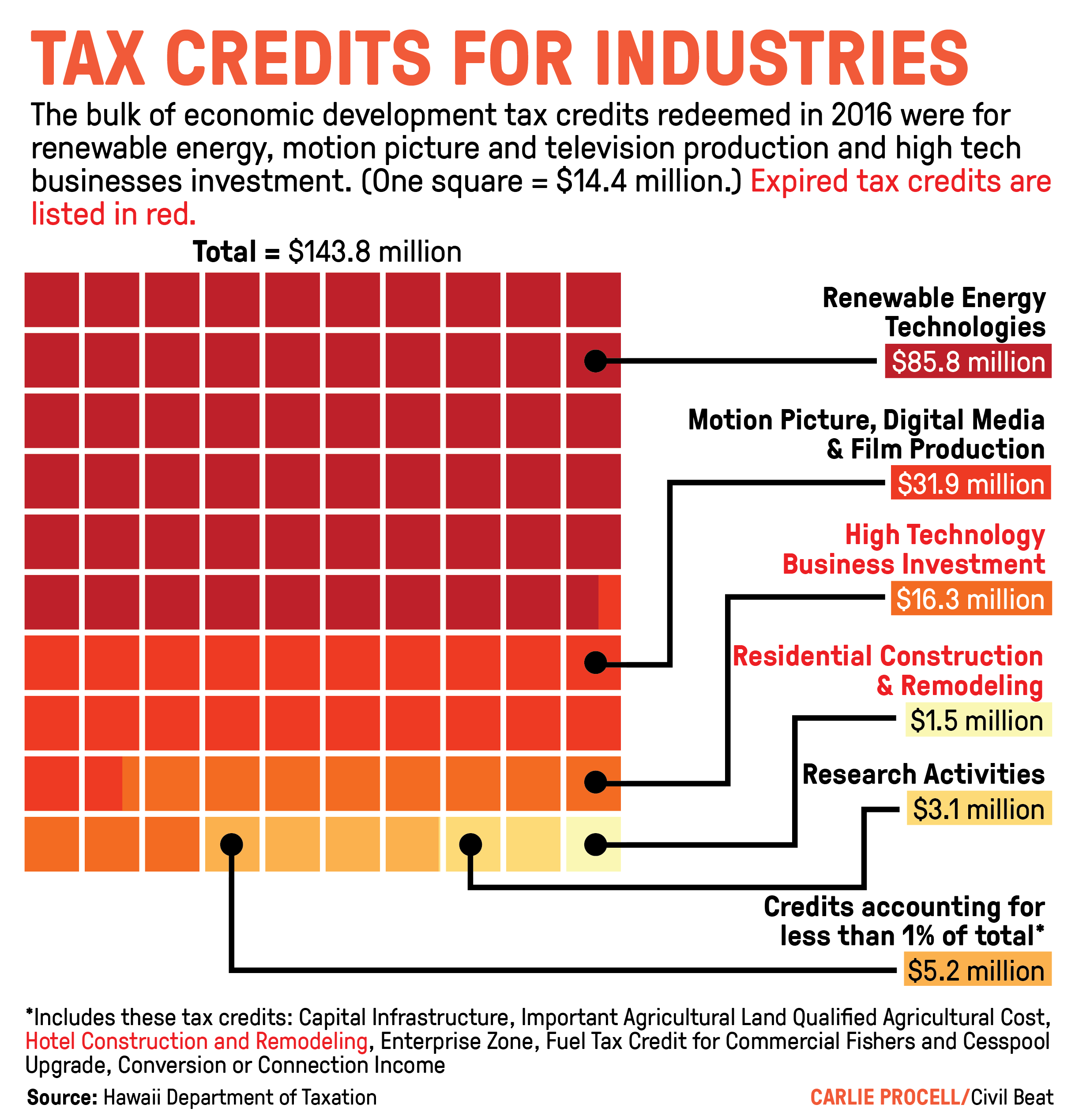

This Long Expired High Tech Tax Credit Is Still Costing Hawaii Millions Honolulu Civil Beat

Duke S Waikiki Grilled Fruit White Bean Hummus Papaya Seeds

Is Shipping Taxable In Hawaii Taxjar

Us States With The Highest And Lowest Per Capita State Income Taxes Map American History Timeline Mapping Software

38 Vintage Hawaiian Wallpaper On Wallpapersafari Impressionnisme Fond D Ecran Tropical Papier Peint Fleuri

This No Frills Fish Market On The Oregon Coast Belongs On Your Bucket List Beach Fishing Oregon Fresh Fish Market

Does Hawaii Charge Sales Tax On Services Taxjar

Red Paradise Hawaiian Flower Hair Clip

Learn What The Minimum Wage For Servers In Hawaii Is Per Hour In 2022

Mcdonald S Hawaii Special Menu Items Explained

Hawaii Income Tax Hi State Tax Calculator Community Tax

Macfarms Fresh From Hawaii Coconut Macaroon Macadamia Nuts 6 Oz Walmart Com Coconut Macaroons Macadamia Nuts Macaroons

Hawaii Income Tax Hi State Tax Calculator Community Tax

How Much Does It Cost To Start A Food Truck In Hawaii How Much Do Food Trucks Make In Hawaii Youtube

This Long Expired High Tech Tax Credit Is Still Costing Hawaii Millions Honolulu Civil Beat

Mcdonald S Hawaii Special Menu Items Explained

Pinned March 9th Free Fries Drink With Your Cajun Fish At Arbys Thecouponsapp Chicken Tender Recipes Roast Beef Recipes Food